Performance dispersion is a golden opportunity for active investors

Discover how ample the performance dispersion is across stocks and learn how you can profit from it. Every investment universe exhibits a broad performance dispersion.

Whatever your investment approach and selection strategy is, you can exploit the broad performance dispersion, existing in your own investment universe.

S&P 500 Investment Universe

2023 Performance Dispersion Facts:

Top 25% Performers (Average Return)

+50%

Index

+24%

Bottom 25% Performers (Average Return)

-17%

2022 Performance Dispersion Facts:

Top 25% Performers (Average Return)

+22%

Index

-19%

Bottom 25% Performers (Average Return)

-44%

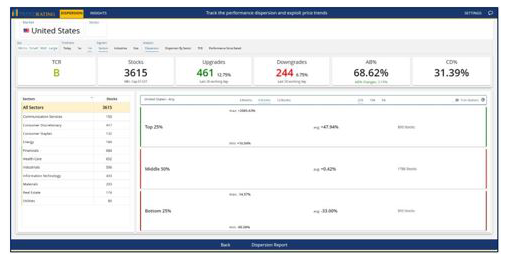

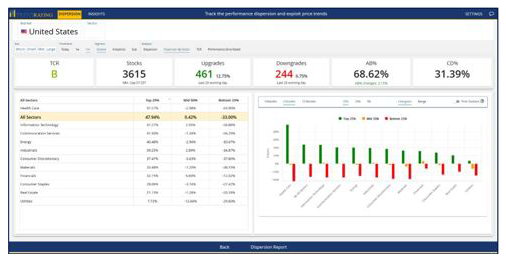

Below you can find free up-to-date statistics to measure and analyze the dispersion in the markets and sectors of your interest. Next you can learn how to exploit dispersion by discriminating between best and worst performers.

Performance dispersion data - Discover the magnitude of dispersion.

See the dispersion insights at market and sector level below.

Click on the flag in order to get the desired report.

It’s nearly impossible to find educated people in this particular subject. However, you

seem like you know what you’re talking about! Thanks.

Proft from performance dispersion with smarter analytics and technology!

Track the dispersion in real time and profit from it!

Analyzing the performance dispersion across markets and sectors enables investors to make

more informed investment decisions. Trendrating offers free access to critical market

intelligence covering dispersion statistics on different time windows.

Gain free access to our alpha dispersion monitoring service. Fill the below form and a Trendrating representative will contact you within 24 hours

How can you profit from the dispersion inherent in your investment universe?

Discover Trendrating proprietary advanced rating methodology.

Our trend discovery model provides a rating metric to discriminate bull vs. bear trend and to quickly spot trend reversals across stocks with a high level of accuracy.

Why it works?

Our approach works because is agnostic, opportunistic, pragmatic and unbiased, as it is based on a multi-factors AI pattern recognition model that avoids any human interpretation and forecast. Our fresh, innovative data and technology delivers a layer of logical market intelligence whose value is fully transparent and measurable.

Evidence of accuracy

Our 250+ clients use Trendrating advanced analytics to gain critical insights and profit from performance dispersion. Here you find a few links to documented evidence of the effectiveness of Trendrating analytics:

Articles

- Industrial Average Historical Trends

- Dispersion and Alpha Conversion

- Cross-sectional Dispersion

- What Price Trends and History Tell Us About What's Next for the Markets

- The Performance Dispersion Opportunity for Active Investors

- What is Performance Dispersion?

- Exploiting Performance Dispersion

- U.S. Performance Dispersion Navigator

Better Information ● Better Decisions ● Better Investing

Gain a critical edge and expand your market intelligence.

Make trends work for you.

Do not miss profitable opportunities anymore.

Start boosting your investment returns.

Discover how our solution can give you an edge. Fill the below form and take a 15-minute demo session, focusing on the investment universe of your interest.

About Trendrating

Trendrating is a global leader in the field of advance analytics and trend capture technology. We offer a new, different set of analytics and tools to measure performance dispersion and rate price trends, filtering out market noise, arguable opinions and disputable research. Serving more than 250 institutional customers globally, our proprietary methodologies are used as part of their investment decision-making process in wealth management, private banking, advisory and hedge fund fields to maximize returns and better control risks. Our key strategic partners include Bloomberg and Euronext.

London

Trendrating Ltd

Octagon Point – 5 Cheapside

London, EC2V 6AA

United Kingdom

- +44 (20) 3823 2215

- info@trendrating.net

Boston

Trendrating Inc.

6 Liberty Square, 6100

Boston, MA 02109

USA

- +1 508-315-6313

- info@trendrating.net